April 28, 2019

Growing Your Wealth in Your Retirement!

My peers, siblings, cousins, and schoolmates are transitioning from “work life” to retirement. This means their savings must begin working for them. Money needs to support their lifestyle while they live off retirement income.

How can you continue to earn money while you live off your retirement? The answer is simple. You must EARN more money than you spend. You must invest savings in opportunities that RETURN higher values than the AVERAGE return.

Over many years, a great average return from investment portfolios has been 8%. Most individuals do not receive these returns.

Current five-year APY (annual percentage yield) CD rates are as high as 3.10%. Bank CD’s are considered safe investments by many seniors. The problem with Bank CD’s is they won’t deliver enough interest to Make More than you Spend. In most cases they don’t keep up with annual inflation rates. Bank CD’s also lock you into a long-term investment period. If you need to cash in from your CD investment, you lose the interest. CD’s are not a good investment.

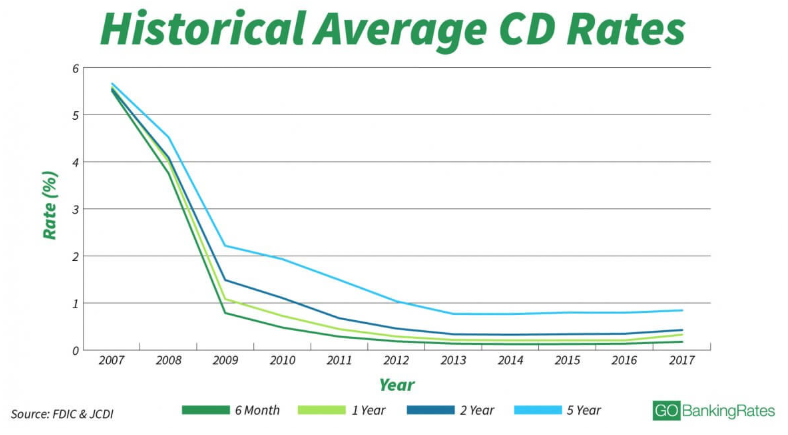

Historical Average CD Rates

This chart is from an article by John Csiszar, “Money-Making Strategies for Current CD Interest Rates”.

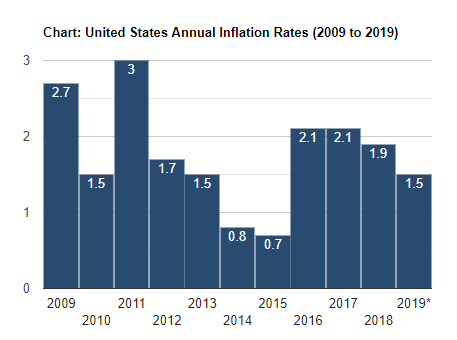

While annual inflation rates have been relatively low for the last ten years, CD rates have been much lower than the inflation rate.

US Annual Inflation Rates

Source: Coin Media Group LLC

Private Money Lending

There are very few safe investment vehicles that deliver more value for individuals than being a Private Money Lender. You probably haven’t heard about Private Money Lending.

PML Bank

Private Money Lending (PML) is when you become the Bank. You elect to loan your money to individual projects for short terms (3 months, 6 months, 9 months, or 1 – 2 years). Most projects will be residential or commercial real estate projects.

Money is necessary to fund real estate projects. Money is used to purchase properties, remodel properties, for building tradesmen & women, materials, permits, inspections, marketing, closing, etc. Up to 70% of the money used to rehab a property is borrowed from Private Money Lenders. The other 30% is provided by other lenders or is equity provided by project Investors.

A Private Money Lenders position is secured in the project by five official instruments:

Official Documents

- Promissory Note

- First Lien Position

- Deed of Trust

- Lien Waivers

- Loss Payee on Insurance

These are official contracts between the investment group and the PML. Some of these documents are recorded in the county court house. Each project, in most cases, comes under the umbrella of a newly formed Limited Liability Corporation. The LLC lasts the duration of the project. The LLC protects investors (including the PML) from obligations each investor may carry outside the LLC.

Depending on the project we pay our PML’s 8%-12% simple APR (annual percentage rate) for the use of their capital. If you’re interested in learning more about Private Money Lending, please contact me. We have projects for you to invest in now.

We offer short seminars to educate people about Real Estate projects & Private Money Lending. You can schedule an appointment in our Houston office, or we can use Zoom Online Meeting to meet with you.

There are three ways a Private Money Lender can invest in our projects. Each Investment Style will deliver different benefits to a PML.

All investments require risk; however, our team and our methods do everything possible to mitigate risk. Remember, our money, treasure, and time is invested in the same projects in which our PML’s participate.

I hope to see you soon!